This interest calculator determines the growth of a one-off investment with compound interest. Usage instructions and explanations of the underlying mathematical formulas follow after the calculation form.

| Result Details: | hide - |

| Years | Period Interest | Total Interest | Balance |

| 0.00 | 0.00 | 0.00 | 1,000.00 |

| 0.50 | 20.00 | 20.00 | 1,020.00 |

| 1.00 | 20.40 | 40.40 | 1,040.40 |

| 1.50 | 20.81 | 61.21 | 1,061.21 |

| 2.00 | 21.22 | 82.43 | 1,082.43 |

| 2.50 | 21.65 | 104.08 | 1,104.08 |

| 3.00 | 22.08 | 126.16 | 1,126.16 |

| 3.50 | 22.52 | 148.69 | 1,148.69 |

| 4.00 | 22.97 | 171.66 | 1,171.66 |

| 4.50 | 23.43 | 195.09 | 1,195.09 |

| 5.00 | 23.90 | 218.99 | 1,218.99 |

| 5.50 | 24.38 | 243.37 | 1,243.37 |

| 6.00 | 24.87 | 268.24 | 1,268.24 |

| 6.50 | 25.36 | 293.61 | 1,293.61 |

| 7.00 | 25.87 | 319.48 | 1,319.48 |

| 7.50 | 26.39 | 345.87 | 1,345.87 |

| 8.00 | 26.92 | 372.79 | 1,372.79 |

| 8.50 | 27.46 | 400.24 | 1,400.24 |

| 9.00 | 28.00 | 428.25 | 1,428.25 |

| 9.50 | 28.56 | 456.81 | 1,456.81 |

| 10.00 | 29.14 | 485.95 | 1,485.95 |

Usage Instructions for the Compound Interest Calculator Form

Please fill the form with an initial amount of money to invest, a nominal interest rate and the investment period in years for which you would like to earn compound interest. All fields above the calculate button refer to input values, which you can change as needed. From these inputs the financial calculator determines the final amount your investment will be growing to.

The compounding frequency field adjusts how often the computation reinvests interest income. By default, it sets the frequency to one, equivalent to annual compounding appropriate for most users. In order to match modalities of special investment accounts, you can choose overrides to two (semi-annual compounding), four (quarterly compounding), or twelve (monthly compounding).

In addition to the final amount shown in the form, the result details section lists intermediate account balances. For extended investment periods, this detailed view can grow quite long. Therefore, you may choose to hide it by clicking on the “hide -” label in its upper right corner.

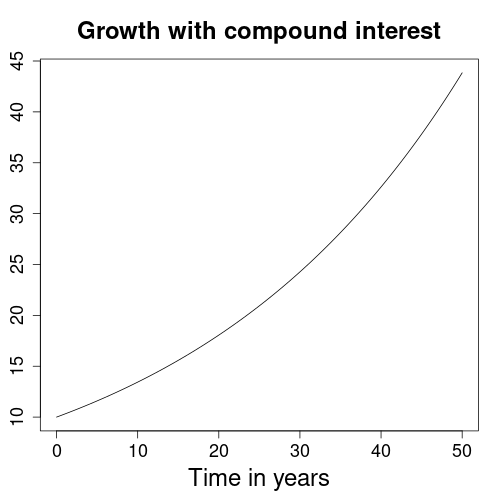

The image above gives an example of how an initial investment of $10 multiplies over a time span of 50 years at 3% annual interest. Due to the exponential nature of compound interest, the growth of the investment accelerates with time.

Mathematical Formula

The compound interest calculator form uses the following formula to compute the final valuation of the initial investment:

B(t) = B0 * (1 + r/m)(m*t)

B0: initial investment (at time 0)

B: investment value at time t

t: investment period in years

r: annual interest rate

m: compounding frequencyThe compound interest formula assumes an investment of amount B0 made at time t=0. Therefore, you can insert the investment period in years or any of the intermediate times from the details section directly into the formula. Note how inserting zero as investment time span renders both interest rate r and compounding frequency m irrelevant and that the compounding frequency enters the formula twice. With m=1 equivalent to annual compounding the computation then simplifies as follows:

B(t) = B0 * (1 + r)tFor instance, with an interest rate of 10% over a two year investment horizon and annual compounding, you would then get

B(2) = B0 * (1 + 0.1) * (1 + 0.1)

B(2) = B0 * 1.21With semi-annual compounding and same interest rate of 10% over two years, the example changes to the following:

B(2) = B0 * (1 + 0.1 / 2)(2*2)

B(2) = B0 * 1.05 * 1.05 * 1.05 * 1.05

B(2) = B0 * 1.21550625So the impact of the compounding frequency on the final result is relatively minor. For a change from annual to semi-annual compounding, the growth factor increases from 1.21 only to 1.21550625.

References

Compound interest: Wikipedia.org

Similar Calculations

Savings plan calculator: finalgebra.com

Compound interest calculator in German: zinseszins.de.