This interest calculator determines the annual rate of return on an investment (ROI). Usage instructions and explanations of the annualized return on investment follow after the calculation form.

Usage Instructions for Calculator

Please fill the form with the purchase price of an investment, the future proceeds, and the investment period in years. All fields above the calculate button refer to input values, which you can change as needed. The form calculates the corresponding annual return on investment from these inputs.

Compounding defaults to annual reinvestment of earnings. This setting will be appropriate for most users. However, you may change the compounding mode to semi-annually, quarterly, or monthly.

What is Return on Investment (ROI)

ROI is the ratio of net proceeds over the initial investment.

ROI = Net Proceeds / Initial Investment

For instance, if you bought a stock for $100 and sold it for $400, your ROI will be 300%.

ROI = (400 – 100) / 100 = 3 = 300%

However, in this simplicity the ROI is not a good measure for investment performance. This is because it does not take account of the time it took to achieve an overall gain. Instead, investors should focus on the annualized return.

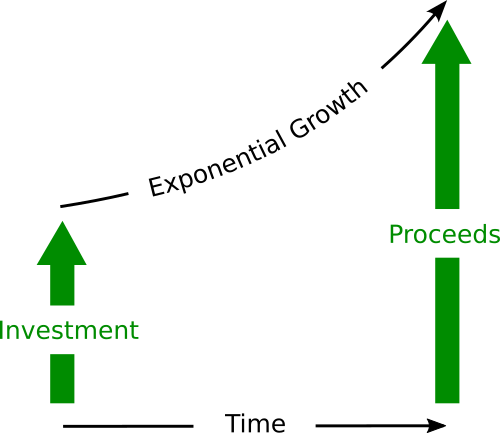

For the annualized ROI, we assume exponential growth between buying and selling. Therefore, we have the following relationship between investment and proceeds:

Proceeds = Investment * (1 + r)t

r: rate of return

t: time in yearsIn order to find the corresponding annual return, we can rewrite the formula for the proceeds.

r = (Proceeds / Investment)(1/t) -1Coming back to our previous example of the stock value growing from $100 to $400, we can pluck in the following values assuming an investment period of 1 year:

r = (400 / 100)1 – 1 = 4 – 1 = 3 = 300%

But if we had waited for 10 years to achieve the same sales price, our annualized return would be:

r = (400 / 100)(1/10) – 1 = 1.14870 – 1 = 0.14870 = 14.87%

Mathematical Formula for Annualized Return on Investment

The calculator form uses a more generalized form of the return equation taking the compounding frequency into account:

ROIa = ((P / I)(1/(m*t)) - 1) * m

ROIa: annualized return on investment

P: proceeds

I: investment

m: compounding frequency

t: time in yearsReferences

Rate of Return: Wikipedia.org

Similar Computations

Return on Investment in German: zinseszins.de