Installment loans are a very common form of consumer credit with repayments in equal installments at regular intervals. Mortgages, car loans, cash advances, and installment purchases are examples of this type of contract.

Five parameters define the contractual terms of installment loans: the initial loan balance, the remaining loan balance at the end of the term, the contract term, the installment amount and the loan interest rate. However, the choice of these parameters is not arbitrary, because the remaining fifth can be calculated from combinations of four.

There are therefore five basic variants of installment loan calculators, three of which are covered here: the outstanding loan amount at the end of the term, the amount of the installment payments and the loan interest rate.

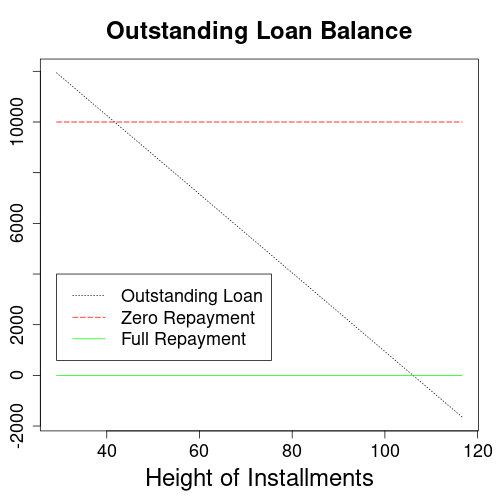

Outstanding Loan Amount Calculator for Installment Loans

The end of term outstanding loan amount calculator takes the initial loan balance, term, installments, and loan rate for input. From this, it computes the outstanding loan balance at the end of the contract.

The above diagram shows the end of term loan balance depending on the installment payments. The part of the loan that has been repaid at the end of the contract is obviously proportional to the amount of the installment.

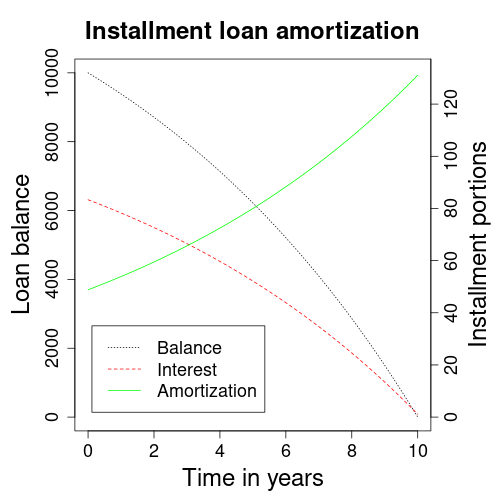

Height of Installment Calculator for Installment Loans

The height of installment calculator takes the initial loan balance, term, end of term loan balance, and loan rate for input. From this, it computes the height of regularly payable installments.

Generally, consumers are better off with installment loan contracts that repay quickly. This is because longer running contracts charge more interest, which ultimately raises costs. The diagram above visualizes this relationship, since interest is highest and amortization lowest the longer the contract is still running.

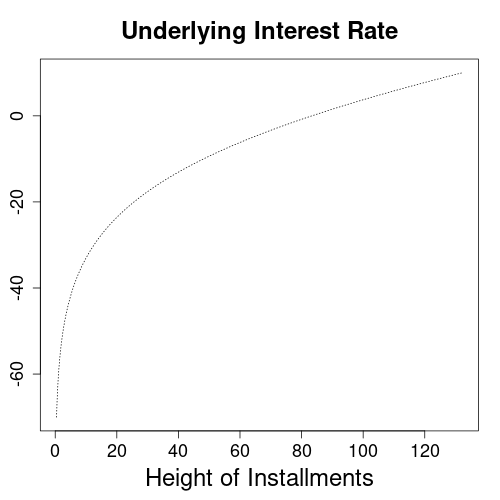

Underlying Interest Rate Calculator for Installment Loans

The underlying interest rate calculator determines the interest rate that a lender charges. Calculation inputs are the initial loan balance, the ending loan balance, the height of installments, and the term of the contract.

As the diagram above demonstrates, an underlying interest rate can be determined for practically every credit scenario, at which the installments completely repay the loan balance. In the example, a loan of $10,000 with monthly installments of only $1 pays off within 10 years, assuming an interest rate of -70%. Unfortunately, it will be difficult to find lenders on such terms.

References

Mortgage Loans: Wikipedia.org

Amortization calculator: Wikipedia.org

Similar Computations

Installment loan calculators in German: zinseszins.de