The savings plan calculator determines the growth of a savings account with regular deposits and interest earnings. Results are applicable to certain types of pension insurances with fixed interest and contributions. Usage instructions and explanations annuity savings plans follow after the calculation form.

Usage Instructions for the Savings Plan Calculator

Please fill the calculator form with the height of regular deposits, a nominal interest rate, and the duration of the savings plan in years. All fields above the calculate button refer to input values, which you can change to your needs. From these inputs the form computes the final account balance and total capital gains.

Per default, the computation assumes monthly contributions. Most users will be fine with this setting. However, you may choose four (quarterly), two (semi-annual), or one (annual) contributions.

In addition to the final balance, the calculator produces intermediate results in its details section. Since this list can grow quite long, you may prefer to hide it by clicking on the “hide -” label in its upper right corner.

Annuity Savings Plans

Annuities are series of payments made at regular intervals and the special case of fixed payments is a fixed annuity. The future value of a fixed annuity is then a technical term for the balances output by the savings plan form. Provided that balances earn interest, their present and future values differ and the purpose of the savings plan calculation is to find out by how much.

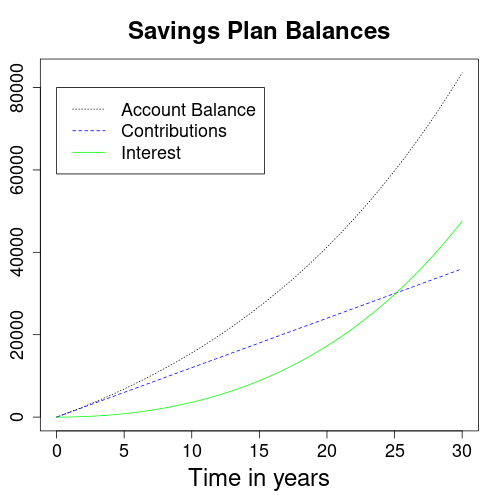

At start, the growth from interest is negligible compared to contributions. Only after a sufficient balance builds in the account, interest earnings top contributions. Take the plan in the above graph as an example. With 5% of interest, savers wait more than 25 years until interest earnings match contributions. This is where the dashed blue and solid green lines cross.

To summarize, the compound interest effect lifts up annuity savings balances with considerable delay. Nevertheless, it is not necessarily a good idea to commit early to annuity savings for retirement income. Only if the interest rate exceeds inflation, savers benefit in terms of real purchasing power. However, for multiple decade savings plans it is likely that periods of high inflation cancel out interest gains.

As a consequence, savers may be better off investing in inflation protected assets, such as real property.

For better intuition on the effects of inflation, you could try out the inflation or pension present value calculators.

Mathematical Formula for the Savings Plan

The savings plan calculator uses the following mathematical formula:

FV = C0 * m / r * ((1+r/m)m*t - 1)

FV: future value of annuity savings

C0: constant contribution

r: interest rate

m: number of contributions per year

t: time in yearsReferences

Annuities: Wikipedia.org

Similar Computations

Savings Plan Calculator in German: zinseszins.de